|

EN |

|

Gold is money.

|

Gold as money

“Paper money eventually returns to its intrinsic value, zero.”

Voltaire

Making gold into an ideal money medium

Gold is an almost ideal money medium. It is durable as it is a precious metal and therefore does not perish or disintegrate. Gold is naturally scarce and therefore valuable, resistant to counterfeiting and cannot be multiplied by decree.

Gold naturally serves as a store of value and fungible medium of exchange. Gold is universally accepted, and bears no counterparty risk.

On the downside, gold is heavy for its size and not easily divisible. Physical transfers are costly and involve security risks. For larger quantities, cross border transport is cumbersome for the average gold owner.

The newest form of money, Bitcoin, is so successful because it also comes close to being an ideal money medium: Its supply is limited and is therefore scarce. It does not require gatekeepers. And it is not created from debt but from energy, and is therefore also regarded as (a form of) commodity based money.

Bitcoin provides financial privacy while being transparent. It is trustless, meaning there is no centralized control required. On the downside it is usually argued that Bitcoin is also a form of fiat, as it is created by (community) decree and essentially unbacked.

Now, combining gold with the capabilities of blockchain technology as a gold-backed crypto currency, makes gold the ideal money.

A gold backed crypto currency transforms physical gold into a flexible digital asset. It becomes liquid and transferable via the blockchain without the need to physically move gold bars. As a crypto currency gold is easily divisible and can be exchanged globally in a decentralized way, without the need for intermediaries.

A gold backed crypto currency that can be redeemed against physical bars can serve as universal store of value and medium of exchange.

Gold backed NFTs offer direct ownership and intermediary free transferability of gold bars.

Source: https://swissgold.io

Gold outperforms fiat

In 1971, US President Nixon was forced to abolish the gold standard because the USA had printed too much money to finance the Vietnam War, among other things. The growing discrepancy between the value of the US dollar and the amount of gold held by the United States led to inflation and to Europe's central banks exchanging their dollars for gold en masse.

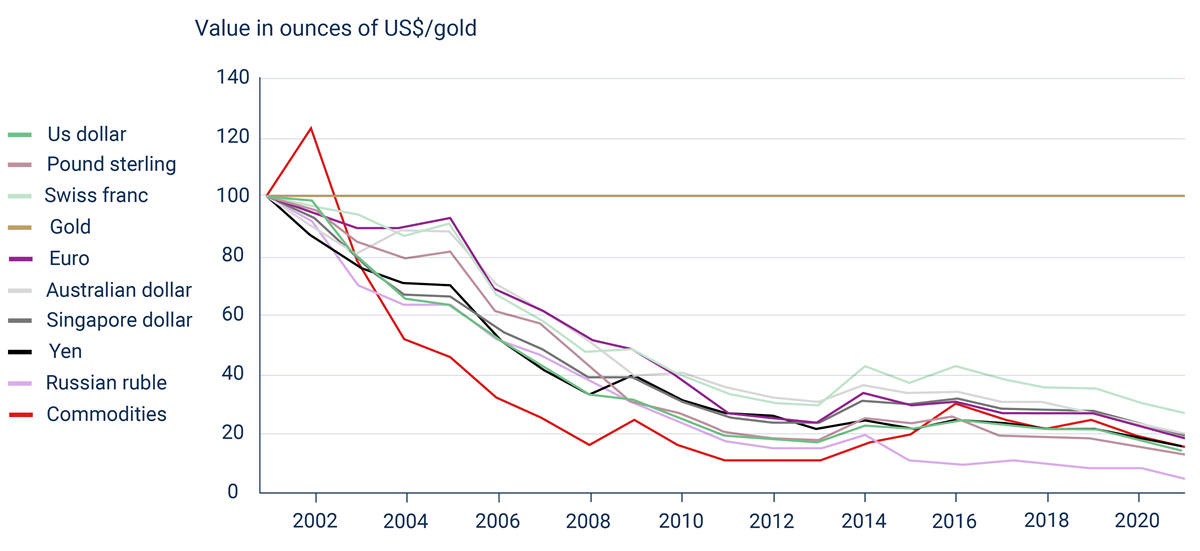

Since 1971, the US dollar has lost more than 90% of its purchasing power and as much as 97% of its value against gold. The purchasing power of the euro has fallen by 77% in the just over 20 years since its introduction in 1999. Even the Swiss franc has depreciated by 70% against gold. Essentially, gold has held its value, while fiat currencies have depreciated against gold due to the massive expansion of their monetary base.

Another important point that should be noted is that the price of gold is currently being kept artificially low mainly by speculation by the major US banks with paper gold (i.e. derivatives without backing) in order to keep gold unattractive against the further devaluing fiat currencies. There is widespread speculation that this dominance may no longer be sustainable in the near future as the main weight of the global economy continues to further shift towards the East.

Performance of fiat currencies and commodities versus gold.

Source: https://www.goldavenue.com/de/blog/newsletter-edelmetall-spotlight/gold-gegen-papiergeld

The world order is shifting East

The BRICS block formed in 2009, with 43% of the world population living in BRICS countries. The blocks expansion is underway with new members to include Mexico, Indonesia, Turkey, Argentina, Iran, Nigeria, Egypt, Bangladesh, Vietnam, South Korea, Saudi Arabia.

The Shanghai Cooperation Organization (SCO) formed in 2001 consists of 8 member states plus observers and partners, totaling to 60% of the world’s population. The SCO will soon include four members of OPEC+ that provide at least 70% of the cartel’s oil production.

Together both organizations account for the majority of the world population, resources and oil production. Four of the BRICS nations are among the world’s major gold producers, namely, China, Russia, South Africa and Brazil and look to establish their own gold trading system. The central banks of the SCO countries have been accumulating gold in recent years at a rate not seen in 55 years, with over 1'136 tons in 2022 alone.

The BRICS have recently announced to move to a new reserve currency, and individual members have already started to abolish the US dollar in their bilateral trade transactions.

It is widely expected, that the ongoing "de-dollarization" of global trade, which is currently taking place gradually but could switch to suddenly at any given time, will lead to major challenges for the US dollar system, and thus for US dollar-backed stablecoins.

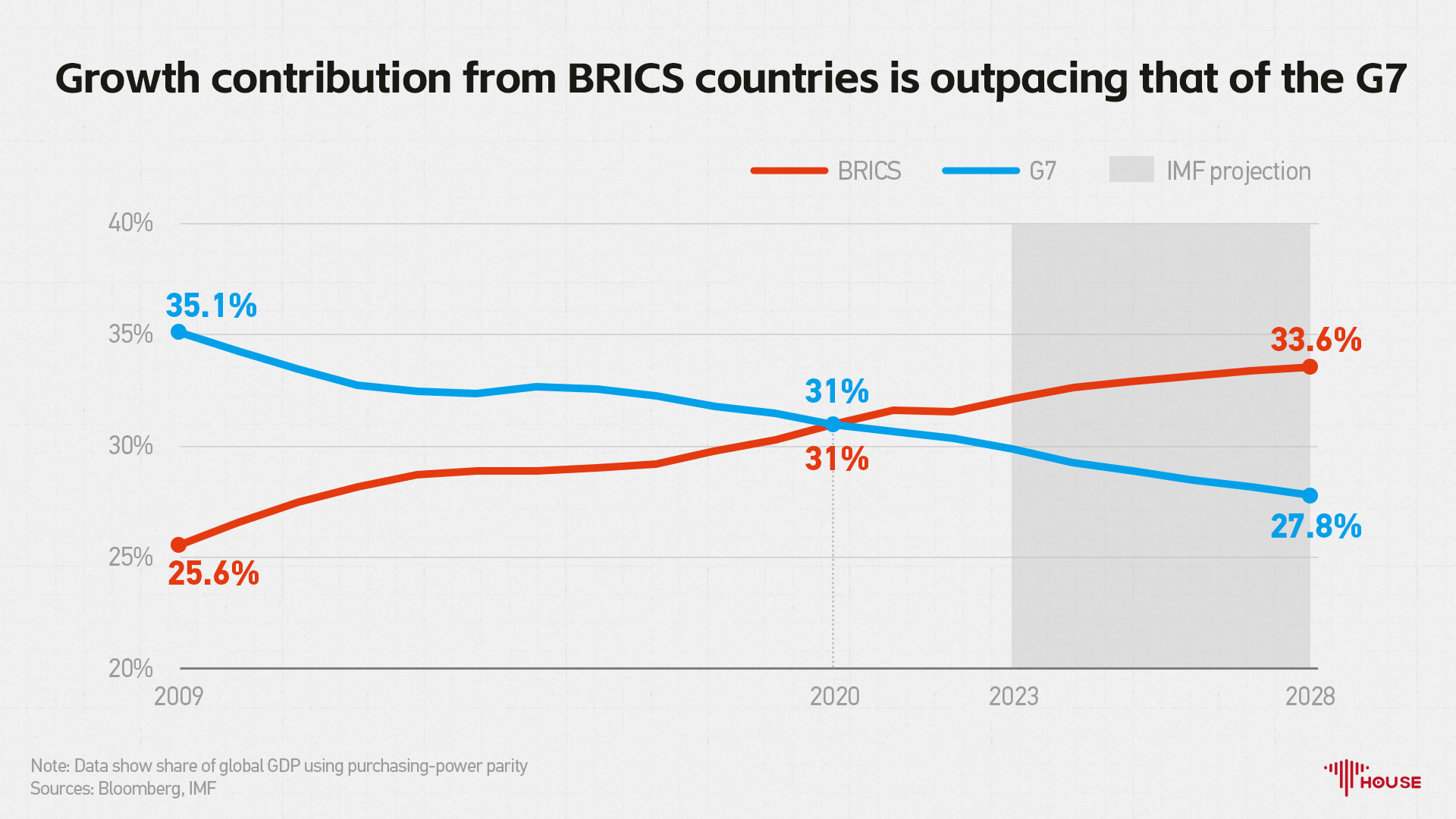

The first tipping point occurred back in 2020 when the GDP of the G7 countries started to fall behind that of the BRICS countries for the first time.

The world economy is shifting East

Source: https://news.cgtn.com/news/2023-05-16/Growth-contribution-from-BRICS-countries-is-outpacing-that-of-the-G7-1jQYXgcMIOQ/index.html

A world gold currency

WORLDGOLD is designed to provide an alternative and better money than current USD or other fiat based stablecoins, or upcoming CBDCs.

Gold is naturally valuable and therefore predestined as the ideal backing to create a sound money that is independent of any interest politics or monetary policy.

Gold as a crypto currency is not only technically an ideal money, it is also the ideal store of value compared to fiat money. As it is scarce, its value rises with increasing adoption, just like Bitcoin. It can therefore protect wealth and help people to truly participate in the wealth creation of the global economy.

To live up to the promise of blockchain technology, both storage of the gold used for backing and the issuance of the crypto currency must be as decentralized as possible to avoid risks emanating from a particular jurisdiction and/or political interests. Even a DAO-type organization is still one singular organization that can fall victim to vested interests.

WORLDGOLD is issued and brought to market through a decentralized network of geographically diversified partners that are regulated in their respective jurisdictions.

The gold used for backing is also decentralized by storing it in certified vaults in different geographical locations. The asset tracking technology used enables gold holders of all sizes to participate in the backing and earn on the gold staked.

Be part of the journey. Contact us contact@worldgold.io

_____________________

A brief overview of the medium of money from its beginnings to Bitcoin can be found here: https://carolehofmann.net/info/gold_is_money_en.php

|

© 2024 WORLDGOLD |

|